Dream of owning a vacation home but find the idea of buying one too intimidating? It’s actually easier than you may think. Here’s a guide to help you analyze your options.

1. Match housing choices to your lifestyle

Many people assume they must own a primary residence before owning a vacation home, but that’s not necessarily true. What’s really important is matching your housing choices to your lifestyle.

You may live in a city and want lots of space that you can’t afford there. You could rent a modest condo in the city and buy a large vacation home outside the metro area.

Or you may live in a large country house and want to enjoy city life as much as you can. In that case, you could own your country home and also buy a vacation condo in the city.

Either way, the financing and tax implications are almost the same.

2. Decide how you’ll use it

From a financing and tax standpoint, you need to consider how you intend to own and use your property. You have three options:

Primary residence. You can buy for as little as 3 percent down (if your loan doesn’t exceed $417,000), and you get significant homeowner tax benefits.

Second home. You can use your second home anytime you want, but lenders won’t let you rent the home. Buy for as little as 20 percent down, and qualify for the loan using your full primary residence cost plus your full second home cost. Mortgage rates and tax benefits are the same as primary residences.

Investment property. You can rent the home and use it when it’s not rented. Rates are .25 percent to .375 percent higher than second home rates, and your down payment usually starts at 30 percent. You qualify for the loan using your full primary residence cost plus your full investment home cost, but you can use rental income to help qualify. Tax treatment is less beneficial, but the extra income can help with affordability.

3. Understand the total cost of owning it

You can determine what you can afford in seconds. Then you’ll find a lender to formally analyze the cash available for down payment, closing costs and reserves. You’ll also calculate the total monthly cost on your existing home (whether you rent or own), plus the total monthly cost on the vacation home.

You also need to plan for personal budget items that lenders don’t use in their qualifying calculations:

4. Review monthly and transactional cost line items

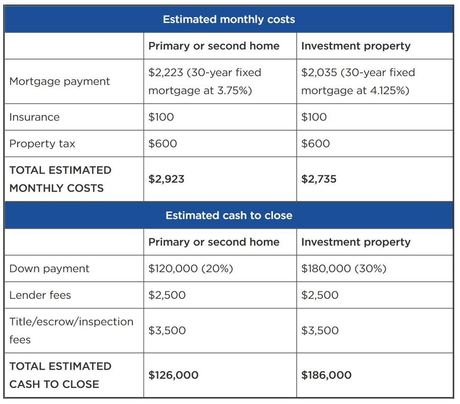

Suppose you live in San Francisco and want to purchase a home in the wine country of Sonoma County, CA, for $600,000. Here’s how much it would cost as a primary residence, second home and investment property.

1. Match housing choices to your lifestyle

Many people assume they must own a primary residence before owning a vacation home, but that’s not necessarily true. What’s really important is matching your housing choices to your lifestyle.

You may live in a city and want lots of space that you can’t afford there. You could rent a modest condo in the city and buy a large vacation home outside the metro area.

Or you may live in a large country house and want to enjoy city life as much as you can. In that case, you could own your country home and also buy a vacation condo in the city.

Either way, the financing and tax implications are almost the same.

2. Decide how you’ll use it

From a financing and tax standpoint, you need to consider how you intend to own and use your property. You have three options:

Primary residence. You can buy for as little as 3 percent down (if your loan doesn’t exceed $417,000), and you get significant homeowner tax benefits.

Second home. You can use your second home anytime you want, but lenders won’t let you rent the home. Buy for as little as 20 percent down, and qualify for the loan using your full primary residence cost plus your full second home cost. Mortgage rates and tax benefits are the same as primary residences.

Investment property. You can rent the home and use it when it’s not rented. Rates are .25 percent to .375 percent higher than second home rates, and your down payment usually starts at 30 percent. You qualify for the loan using your full primary residence cost plus your full investment home cost, but you can use rental income to help qualify. Tax treatment is less beneficial, but the extra income can help with affordability.

3. Understand the total cost of owning it

You can determine what you can afford in seconds. Then you’ll find a lender to formally analyze the cash available for down payment, closing costs and reserves. You’ll also calculate the total monthly cost on your existing home (whether you rent or own), plus the total monthly cost on the vacation home.

You also need to plan for personal budget items that lenders don’t use in their qualifying calculations:

- Gas, electric, cable TV and internet

- Furniture and housewares

- Travel costs to your vacation home

- Total cost of property maintenance items, like cleaning, landscaping and pool/spa upkeep

4. Review monthly and transactional cost line items

Suppose you live in San Francisco and want to purchase a home in the wine country of Sonoma County, CA, for $600,000. Here’s how much it would cost as a primary residence, second home and investment property.

5. Make an offer using a local real estate agent and lender

Many vacation properties are in specialized local markets, so it’s best to find local real estate agents and lenders.

Your real estate agent will clarify local transaction fees, taxes and commissions, as well as advise on local zoning and property rental rules. For example, the town of Sonoma doesn’t allow short-term rentals for vacation homes, but other towns in Sonoma County do.

In destination areas, real estate agent commissions can be higher and can also be seller- or buyer-paid, depending on the area. Only a local expert can advise properly. And, of course, they will structure your offer for you and negotiate on all facets of the deal that are a priority to you.

Likewise, local lenders will be comfortable with appraisals and lending in rural areas. Appraisals are more difficult in less populated areas because comparable sales can be old and hard to find.

If you follow these steps, your closing will be a snap, and you’ll be relaxing in your vacation home before you know it.

Source

Many vacation properties are in specialized local markets, so it’s best to find local real estate agents and lenders.

Your real estate agent will clarify local transaction fees, taxes and commissions, as well as advise on local zoning and property rental rules. For example, the town of Sonoma doesn’t allow short-term rentals for vacation homes, but other towns in Sonoma County do.

In destination areas, real estate agent commissions can be higher and can also be seller- or buyer-paid, depending on the area. Only a local expert can advise properly. And, of course, they will structure your offer for you and negotiate on all facets of the deal that are a priority to you.

Likewise, local lenders will be comfortable with appraisals and lending in rural areas. Appraisals are more difficult in less populated areas because comparable sales can be old and hard to find.

If you follow these steps, your closing will be a snap, and you’ll be relaxing in your vacation home before you know it.

Source